Mokena Enacts Local Grocery Tax to Avert $850,000 Revenue Loss

The Mokena Village Board has moved to preserve a crucial revenue stream, unanimously approving a new local grocery tax to replace state-collected funds that will disappear in 2026. The move is expected to prevent an annual loss of approximately $850,000 to the village’s general fund.

At its June 23 meeting, the board passed an ordinance to implement a 1% Municipal Grocery Retailers’ Occupation Tax, effective January 1, 2026. This action directly responds to the State of Illinois’ decision to repeal its 1% statewide grocery tax, which it shared with municipalities. While eliminating the municipal share, the state allowed local governments to impose their own identical tax to make up for the shortfall.

Village Administrator John Tomasoski explained that without local action, the significant revenue stream used to fund core services would be eliminated.

“Mokena stands to lose approximately $850,000 in annual revenue,” Tomasoski stated during his presentation. He noted the figure was a conservative estimate, representing about 11-12% of the village’s projected state income tax revenue. “This revenue is in our general fund, which currently supports certain things such as public safety, street maintenance, and other community service items that the village here produces.”

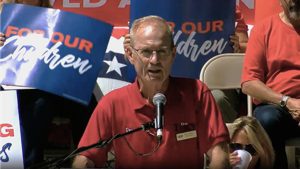

Mayor George J. Metanias was quick to clarify that the ordinance does not represent a tax increase for consumers at the register.

“I want residents to understand, this is not us raising your taxes by 1%,” Metanias said. “That’s what it was. Apparently, the governor decided to take that away, and we’re just putting that back, the same amount. So, you’re not getting any anything more than what you were paying before.”

Trustee Terry G. Germany characterized the state’s move as a “political stunt down in Springfield,” thanking the mayor for the clarification.

The new local tax will be administered and collected by the Illinois Department of Revenue, ensuring no interruption in revenue for the village. To meet the state’s deadline, the village must file the certified ordinance with the department by October 1, 2025.

Tomasoski highlighted that Mokena is following a regional trend, with dozens of municipalities in Will, Cook, DuPage, and Kane counties taking similar action to protect their budgets. He also put the tax in the context of Mokena’s overall financial health, noting the village has the lowest municipal property tax rate among many neighboring communities and does not levy electric or natural gas utility taxes.

The ordinance was approved 5-0, with Trustee Daniel C. Gilbert absent.

Latest News Stories

Security clearances of 37 former, current intel professionals revoked

USDA reverses use of taxpayer dollars to fund solar panels on farmland

Governor defends mental health mandate, rejects parental consent plan

Major U.S. retailer reverses course on tariffs, says prices will go up

Illinois quick hits: Arlington Heights trustees pass grocery tax

Plan launched to place redistricting amendment before voters in 2026

Some Russia-Ukraine questions answered Tuesday, more remain

30 charged in TdA drug trafficking, murder-for-hire and firearms offenses

Trump signs bill studying cancer among military pilots

Illinois GOP U.S. Senate candidates point to economy, Trump gains

DOJ promises release of some Epstein records this week

Book: Foreign countries pose greatest threat to free speech on college campuses

Executive Committee Details Spending of $134 Million in Pandemic Relief Funds