Voters to decide two statewide measures, nearly 100 local proposals

As Colorado voters prepare for Election Day, they will vote on two statewide ballot measures and nearly 100 local measures across 30 counties.

Those measures will amount to over $1 billion in bonds or tax increases.

The Center Square spoke with Thomas Aiello, senior director of government affairs at the National Taxpayers Union, in an exclusive interview about the organization’s 2025 Ballot Guide.

Aiello said Colorado taxpayers are in a unique situation compared to other voters across the nation.

“Colorado has perhaps the strongest Taxpayer Bill of Rights out of any state in the country,” he explained. “This helps protect taxpayers and requires local governments to provide as accurate information as possible when seeking voters’ approvals for tax increases.”

First passed in 1992, TABOR allows Colorado to lead the nation as the only state that has a revenue cap on how much money the state can bring in. As part of the state constitution, it has a few key requirements:

• The state may only retain an amount of revenue equal to the previous year’s revenue, with adjustments made each year for population growth and inflation.

• Above that, the state is required to refund any additional money brought in back to the taxpayers.

• It also requires that any increase in taxation goes to a vote of the people.

Despite those requirements, Aiello said the NTU still found that not every measure had details about the impact on taxpayers.

“However, in our 2025 Ballot Guide we find that 23% of measures offer taxpayers no fiscal information on what their taxes would increase by – that’s almost 25% of all local measures,” Aiello explained.

The two statewide measures look to increase funding to subsidized school meal programs.

Under Proposition LL, the state would be allowed to maintain current tax deduction limits for individuals earning $300,000 or more annually.

That amount, which totals $12.4 million in excess tax revenue, would then be used to fund the Healthy School Meals For All program. Generally, under TABOR, excess revenue must be refunded to taxpayers.

Proposition MM allows Colorado to increase income taxes by $95 million annually to pay for school meal programs. This would fund free school meals for all Colorado school children.

The NTU is concerned about the tax implications of these measures.

“Colorado historically has treated all taxpayers well and fostered a low tax environment,” Aiello said. “However, recent ballot measures, including these two measures, continue to upend Colorado’s welcoming tax environment.”

While there has been no organized efforts against these proposals, Republican lawmakers voted against them appearing on the ballot.

A coalition of Democrat lawmakers and advocacy groups like Hunger Free Colorado have joined together to support the measures, which are a continuation of a proposal passed in 2022 called Proposition FF. While no polling has been conducted on public sentiments towards the two new measures, Proposition FF passed with 57% in support.

Of Colorado’s 99 total local measures, 15 of those measures hope to issue approximately $1.1 billion in bonds. Those bonds have an estimated tax impact of approximately $175 million.

Additionally:

• Two measures hope to issue approximately $66.2 million in bonds without any available tax impact estimates.

• 24 measures look to extend or increase property taxes by approximately $109 million.

• 25 measures look to extend or increase sales and use taxes by approximately $181 million.

• 11 measures look to extend or increase lodging taxes by approximately $23.6 million.

• One measure hopes to extend or increase excise taxes on tobacco products by approximately $325,000.

While Colorado’s other local measures do not have estimates on the impact of local taxpayers, the state still stands apart for the quantity of the measures’ fiscal information available to voters.

Aiello explained that this allows voters to then make better decisions about how to vote on Election Day.

“This isn’t the case for most other states,” he said. “Almost 75% of all local ballot measures this year have no revenue estimates – which unfairly keeps voters in the dark. Legislatures across the country should follow the lead of Michigan, Colorado, and even California, to fix these issues. Taxpayers will be better served when it happens.”

Latest News Stories

Everyday Economics: Housing market and Fed policy in focus in the week ahead

Executive Committee Considers $12,000 Strategic Planning Initiative with University of St. Francis

Mokena Fire Board Appoints Surdel as Commissioner, Increases Office Coordinator Hours

Businesses brace for new tax challenges amid global tariff focus

Illinois takes over health insurance marketplace in 2026 amid skepticism

WATCH: IL state reps challenge IEMA-OHS responses to local agencies

Judge expands restraining order against ‘Beto’ O’Rourke, adds ActBlue

Executive Committee Members Decry Roadside Litter, Call for Action Against Garbage Haulers

Mokena Fire District Invests in Station Upgrades, Modernizes Security with Digital Key System

Reversing Biden’s precedent, students complete FAFSA in minutes at beta-testing event

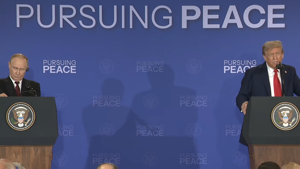

Trump, Zelenskyy to meet Monday in steps toward peace with Russia

Possible ‘agreement’ reached in Trump-Putin meeting; more discussion likely